Selling land you’ve inherited can be a daunting task if you’re unfamiliar with the sales process. But with the right guidance and proper research, selling inherited land can be a breeze.

With experience buying land all over the country, we understand exactly what you need to know to navigate the sales process smoothly. Wondering what paperwork you need to have in order? Or which taxes you’ll owe? How to judge an offer’s fairness? Read on for the answers to these questions and more.

What paperwork do you need when selling inherited land?

If you’ve inherited land after the passing of a loved one, you’ll need to provide a copy of the death certificate and any documentation you have that proves your ownership of the property. If selling the land through an auction, you may also be required to provide a certified appraisal of the property’s value.

Documents that can prove land ownership include deeds, land titles, tax statements, property contracts, and others. If you don’t have any of these documents, don’t worry — an experienced real estate agent or title company can help you track them down.

Once you have all the necessary paperwork in order, the selling process can begin! You’ll work with a professional to price your land, list it on the market, and vet potential offers.

Do you owe taxes after selling inherited land?

The most common type of tax associated with selling land is capital gains tax. This is a tax on the profit you make from selling the property, and it’s calculated based on the difference between the sale price and your “basis” in the property. Your basis is usually equal to the original purchase price of the land, plus any improvements you’ve made to it over time.

For example, let’s say you inherited a piece of land that was purchased for $100,000. You then sell the land for $150,000. The difference between the sale price and your basis is $50,000, which is the amount of your capital gain.

In most cases, you’ll only owe capital gains tax if you sell the property for more than your basis.

Capital gains tax is the most common tax to pay after you’ve sold inherited land. But depending on your location, other taxes may apply too. To learn about them in more detail, see this post on understanding and reducing the taxes you owe after closing.

Selling inherited land can be a confusing process, made even more complicated by the fact that there are different types of taxes you might owe on the sale. It’s important to understand which of them apply to your situation so you can plan accordingly.

Should you perform inspections on inherited land before selling?

As a general rule, it’s always a good idea to have any property you’re selling inspected by a professional before listing it on the market. This is especially true for inherited land, as there may be hidden damage or code violations that you’re not aware of. An inspection will give you a better understanding of the property’s condition and help determine whether any repairs need to be made before selling.

It’s important to note that while most buyers will request a general land inspection, they may also ask for additional inspections depending on the structures and features found on the land.

For example, if you’re selling land that includes a septic system, the buyer may want to inspect the system for cracks and leaks to ensure it’s in good working order.

Similarly, if there are any wells on the property, the buyer may want to have the water tested to ensure it’s safe to drink.

If you’re selling land that has been in your family for generations, it’s understandable that you may not be aware of all the potential issues that could arise during an inspection. This is why it’s always a good idea to consult with a real estate agent or other professional before listing your inherited land for sale.

How can you tell if an offer is fair?

Once you’ve listed your land for sale, it’s only a matter of time before you start receiving offers from interested buyers. But how can you tell if an offer is fair?

The first step is to review the terms of the offer carefully. Does the buyer want to purchase the land “as is,” or are they asking for repairs to be made before closing? Are they offering a fair price based on recent comparable sales in the area?

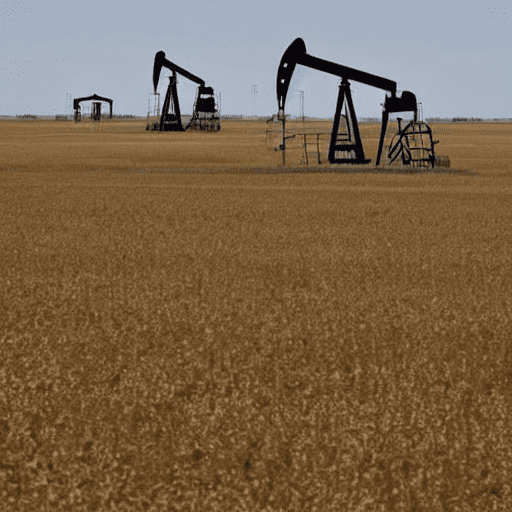

It’s also important to consider the buyer’s motivation for making an offer. For example, if they’re hoping to purchase the land for development, their offer is likely to be much higher than if they’re looking to build a single-family home.

Once you’ve reviewed the terms of the offer and considered the buyer’s motivation, you can decide whether or not the offer is fair. If you’re not sure, it’s always a good idea to get a professional appraisal before making a decision.

Selling inherited land can be complex, but understanding the basics will help you get started on the right foot.

What can I do to boost the value of inherited land before selling?

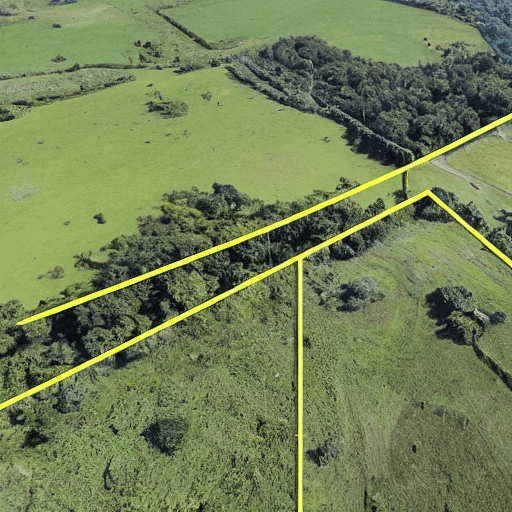

Consider having it surveyed. This will give potential buyers an accurate idea of the size and boundaries of the property. Also, have any structures on the property professionally inspected. This will help you identify any critical issues you must repair before selling.

Finally, consult a real estate agent to get an idea of what comparable properties in the area are selling for. This information will help you price your land competitively and attract serious buyers.

You can take many other measures to boost the value of the land you’ve inherited. We’ve written about them here. By taking these steps, you can maximize the odds of receiving an offer above market value.

Get The Offer You Deserve For Your Inherited Land

Selling inherited land can be tricky, but with proper preparation, you can ensure you get the offer you deserve. First, it’s essential to understand the selling process and what potential buyers will be looking for.

Once you have a good understanding of the market, you can take steps to boost the value of your land before listing your land and considering offers.

Are you interested in selling your inherited land today? Dow Land buys land all over the country. Contact us now to request a purchase offer with no obligation to sell!